The Best Guide To "Tips for Managing Stress and Maintaining Mental Well-being as a Forex Trader"

Popular Mistakes to Stay away from as a Forex Investor

Currency exchanging, also understood as international substitution investing, is a preferred type of assets that makes it possible for individuals to trade currencies in the global market. It uses potential for high profits but additionally lugs a substantial level of threat. In order to maximize your odds of excellence and reduce reductions, it is crucial to prevent common mistakes that numerous foreign exchange traders produce. In this write-up, we will certainly cover some of these oversights and supply ideas on how to stay away from them.

1. Lack of Proper Education and Knowledge

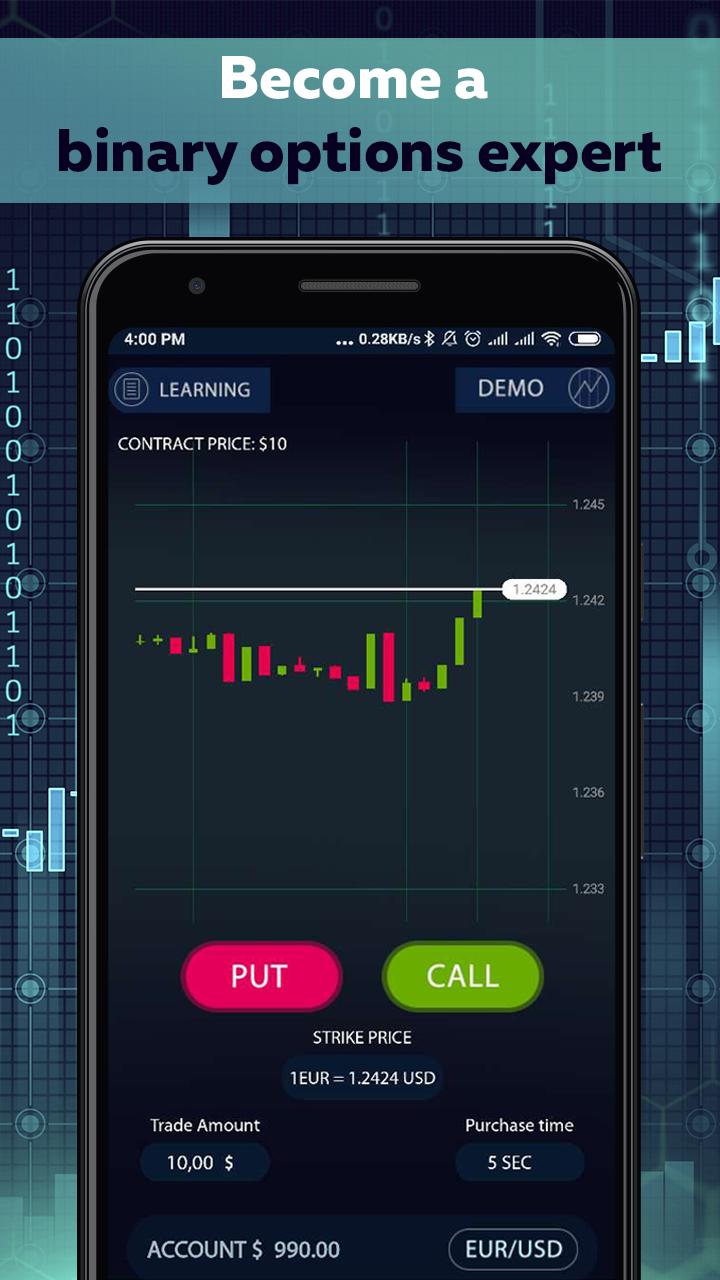

One of the greatest mistakes that foreign exchange traders create is leaping right into the market without a sound understanding of how it works. Foreign exchange investing includes complicated concepts such as technical review, vital study, and threat control. Without effective learning and know-how, it becomes difficult to help make informed choices and establish reliable investing methods. It is necessary to spend opportunity in learning regarding the foreign exchange market with publications, on-line training courses, or attending seminars.

2. Breakdown to Develop a Trading Program

A investing program is like a roadmap that guides forex traders on when and how to go into or exit trades. Many traders create the mistake of not having a well-defined planning in location before they begin trading. Without a plan, emotional states can take over throughout unstable market ailments leading to rash decisions that may lead in significant reductions. A excellent trading planning need to consist of guidelines for threat control, entrance and leave aspects, placement dimension strategies, and suggestions for dealing with emotional states.

3. Overtrading

Overtrading is an additional common oversight one of forex investors which may lead to notable financial losses. Some investors really feel the requirement to constantly be in the market and take several trades at the same time without suitable analysis or purpose behind their choices. This technique commonly leads to inadequate trade quality and enhanced purchase expense such as spreads or percentages paid out to brokers.

4. Neglecting Risk Management

Risk administration is an indispensable part of successful currency trading but is usually disregarded by unskilled traders who are mainly focused on potential revenues. It is crucial to establish the amount of funds you are ready to take the chance of on each business and set stop-loss purchases to restrict prospective losses. Through handling dangers effectively, traders can safeguard their exchanging funding and stay away from considerable drawdowns.

5. Psychological Exchanging

Emotional states can easily significantly influence exchanging decisions, usually leading to unsatisfactory judgment and illogical actions. Greed and worry are two typical emotions that can easily cloud a trader's judgment, leading to them to keep on to shedding field for as well long or go out profitable field also early. It is vital for forex investors to build mental style and catch to their investing program also in the course of times of market dryness.

6. Chasing the Market

Going after the market recommends to getting in business located on impulsive reactions instead than solid evaluation or strategy. This mistake usually happens when investors observe a abrupt rate action and experience the demand to leap in without proper assessment of market problems or styles. Chasing the market may lead to entering into business at unfavorable prices and missing out on possibly lucrative chances.

7. Ignoring Fundamental Analysis

Key study involves analyzing economic signs, headlines occasions, and geopolitical elements that might impact money prices in the long condition. Some foreign exchange traders solely depend on technological study while fully ignoring basic review, which can be a costly oversight. Read This of analysis should be used all together in order to produce well-informed trading decisions.

In final thought, foreign exchange trading uses great capacity for earnings but also brings significant threats. To stay away from usual blunders as a currency investor, it is crucial to educate yourself concerning the market, cultivate a thorough trading strategy, manage dangers successfully, control emotions, avoid impulsive choices, and look at both technological and fundamental evaluation in your decision-making process. Through staying clear of these popular errors, you improve your opportunities of results in this tough but rewarding area of expenditure.